Home Ownership- “The American Dream”

It is difficult to come up with any one definition for the American Dream that every American will agree on. But certainly for many people, it includes homeownership, economic opportunity and diverse communities. For these people, they need to live in a city where homes, and mortgages, are affordable and where it’s possible to climb the economic ladder. Below we look at this special combination of traits to rank the best places for living the American Dream.In order to rank the best places for living the American Dream, we looked at data on five metrics. Specifically we looked at the homeownership rate, diversity rate, upward mobility rate, median home value and unemployment rate.Key Findings

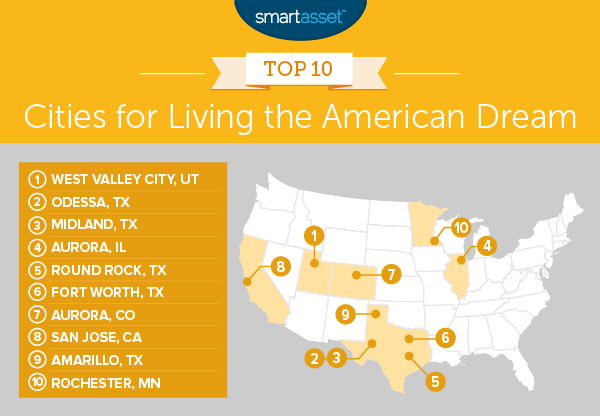

- The dream endures – Six of last year’s top 10 found themselves in the top 10 again this year. Those repeat cities are: West Valley City, Utah; Midland, Texas; Aurora Illinois; Round Rock, Texas; Aurora, Colorado and Rochester, Minnesota.

- Texas is where the dream lives – Half of the cities in our top 10 are located in Texas. Cities in Texas tend to have affordable homes and plenty of good jobs, driving down the unemployment rate and improving upward economic mobility.

Data and Methodology

In order to rank the best cities for living the American Dream, SmartAsset looked at the largest 257 cities which we had data for. Specifically, we compared the cities across the following five metrics:- Diversity score. To create this statistic, we looked at the population percentage of different racial and ethnic groups in each city. A lower number represents more diversity. Data comes from the U.S. Census Bureau’s 2016 1-year American Community Survey.

- Economic mobility. This metric looks at generational change in economic position for families. A higher number shows greater mobility. Data comes from The Equality of Opportunity Project.

- Homeownership rate. This is the percent of households who own their home. Data comes from the Census Bureau’s 2016 1-year American Community Survey.

- Home value. This is the median home value in every city. For this study, a lower home value is considered better as we use it as a measure of affordability. Data comes from the Census Bureau’s 1-year American Community Survey.

- Unemployment rate. This is the unemployment rate by county. Data comes from the Bureau of Labor Statistics and is for January 2018.

Tips for Buying a Home You Can Afford

- Start saving early – You are probably aware of how expensive buying a home can be. However this does not just mean the mortgage payments are expensive. In order to buy a home, you need to have saved for a down payment. In order to have a down payment ready, you need to be saving years in advance. With that in mind, if you have any plans on being a homeowner, it’s a good idea to start saving today for your down payment so that when you find your dream home on the market you are ready to snap it up.

- Factors extras into your budget – Depending on where you are buying your home, property taxes can affect what kind of homes you can afford. For example, the average annual property taxes in New Jersey are $5,503. That is equivalent to paying an extra $458 per month. If you were already nearly unable to afford your home before property taxes, it is likely property taxes will push you over the affordability edge.

SEARCH ALL UTAH Homes

Linda Secrist’s Salt Lake City Real Estate Home Page • Salt Lake City Real Estate • Draper Utah Real Estate • Holladay Utah Real Estate • Sandy Utah Real Estate • South Jordan Utah Real Estate • Salt Lake City’s Top Real Estate Agent

Linda Secrist & Associates is the top selling team in luxury homes in the SLC Market. They have received countless awards over the past 20 years, including “Sales Team of The Year” for over 10 years including 2017! Linda Secrist is #54 in the top 100 Agents in the World in luxury residential real estate. If you’re searching for homes in Sandy, Salt Lake, Cottonwood Heights, Millcreek, Draper, South Jordan, Bountiful, Centerville, Farmington or anywhere in northern Utah, Linda Secrist & Associates are the real estate agents to call. If you’re buying or selling a home, don’t hesitate to text or call us at 801-455-9999!

Linda Secrist & Associates is the top selling team in luxury homes in the SLC Market. They have received countless awards over the past 20 years, including “Sales Team of The Year” for over 10 years including 2017! Linda Secrist is #54 in the top 100 Agents in the World in luxury residential real estate. If you’re searching for homes in Sandy, Salt Lake, Cottonwood Heights, Millcreek, Draper, South Jordan, Bountiful, Centerville, Farmington or anywhere in northern Utah, Linda Secrist & Associates are the real estate agents to call. If you’re buying or selling a home, don’t hesitate to text or call us at 801-455-9999!#mcm #wcw #utahhomesforsale #openhouse #homebuying #utahluxuryhomes #buyahome #homebuyer #utahrealestate #utahrealtor #no1realestateagent #homesforsaleinutah #bestrealtor #skiutah #utahlistings #mlslistings #skiutah #funthingstodoinutah #relocatetoutah #thegreatestsnowonearth #utahskiresorts #worldclassskiresorts #utaheconomy #utahinvestments #stagingyourhome #villasatdimpledell #searchutahhomes #luxuryhomesforsaleinutah #mainfloormaster #homesforsaleinsandyUT #homesforsaleinpepperwood #searchutahhomes #slcvacations #slcdestinations #utahhousingmarket #slchousingmarket #hometrends #luxuryhomes #modernhomes #openfloorplans #relocate #relocation